Editorial Note: We may earn a commission through links from our partners. American Express is an advertiser on The Military Wallet. Commissions do not affect our editors’ opinions or evaluations. Terms Apply to American Express benefits and offers.

Under the Servicemembers Civil Relief Act (SCRA) and Military Lending Act (MLA), active-duty U.S. military members can receive several types of financial relief and protection, including annual fee waivers on premium credit cards.

Here is what you need to know.

Table of Contents

- What is the SCRA and MLA?

- SCRA and MLA Credit Card Benefits

- Determining if SCRA or MLA Benefits Apply to You

- Major Credit Card Issuers and SCRA/MLA Benefits They Offer

- American Express

- Armed Forces Bank

- Bank of America

- Barclays Bank

- Capital One Bank

- Chase Bank

- Citi

- Discover Card

- First Command

- Navy Federal Credit Union

- Pentagon Federal Credit Union (PenFed)

- Synchrony Bank (formerly GE Capital)

- US Bank

- USAA

- Wells Fargo

- For More Information

What is the SCRA and MLA?

The Servicemembers Civil Relief Act (SCRA) provides legal and financial protections to members of the nation’s armed forces.

The SCRA is a law created to provide extra protections for service members in the event that legal or financial transactions adversely affect their rights during military service.

Several credit card protections are included, but service members can also take advantage of other SCRA benefits, including protection against default judgments in civil cases, home foreclosures, repossession of their property, and termination of residential housing and automobile leases without penalty.

The Military Lending Act (MLA) is a companion federal law that protects military members against certain lending practices. Under the MLA, creditors may not charge more than a 36% Military Annual Percentage Rate (MAPR) on a wide range of credit products. In addition to interest, the MAPR also includes costs associated with fees, charges for debt cancellation and suspension, and additional credit products, such as credit insurance. Lenders must disclose to you, orally and in writing, the MAPR that applies to the credit product you seek.

The MLA also requires no mandatory waivers of consumer protection laws. A creditor can’t require you to submit to mandatory arbitration or give up certain rights you have under state or federal laws, like the SCRA.

Creditors also can’t require you to create a military allotment, an automatic amount of money taken from your paycheck to pay back your loan. Also, they cannot charge a prepayment penalty if you repay part or all of your loan early.

Compare the rates, fees, and rewards of top credit cards for military servicemembers and veterans, including cards with waived annual fees under the SCRA.

SCRA and MLA Credit Card Benefits

Specifics will vary for each issuer, but in general, active duty service members may enjoy many of the following benefits:

- No annual fees

- No over limit

- No late payment fees

- No returned payment fees

- No fees for requesting copies of statements

- Waived or reduced credit card cash advance fees

- Cash back incentives

- Cash back programs for military-related expenses such as moving, uniforms, etc.

- No overseas transaction credit card fees

- Incentives for electronic payments or automatic electronic payment transfers

- Lower APR interest rates for military members, including many issuers who offer rates below those mandated by SCRA and MLA.

- Special perks or incentives for deployed service members or their dependents

- Special “reserve cards” for military families

Annual Percentage Rate (APR)

Under the SCRA, credit card rates are capped at 6%. Another important part of the credit card provisions is that most banks and credit card issuing companies will offer a refund on interest and annual fees for certain financial obligations incurred before a servicemember’s active duty military service. For example, if you bought a car or a boat with a 12% loan before serving, you can request to have your interest rate lowered to 6%.

The 6% cap applies to all debts incurred before entry into active-duty service, including student loans, credit cards, mortgages, and car loans. The cap remains in effect for the duration of a servicemember’s active-duty service.

Interest accrued above 6% must be forgiven, not just postponed, and the remaining monthly payments must be reduced to reflect the lower interest rate.

Eligible Branches of Service

All active duty members are covered by the SCRA, including those in the Army, Air Force, Coast Guard, Marine Corps, Navy, Space Force, Reserves, and National Guard. SCRA only applies to reservists and members of the National Guard when they’re serving on active duty orders over 30 days.

How to Access Benefits

To access SCRA benefits, servicemembers must apply to the lending institution where they are seeking the reduction.

Most types of consumer loans offered to active-duty servicemembers and their dependents must to comply with the MLA. These credit products generally include:

- Payday loans, deposit advance products, and vehicle title loans

- Overdraft lines of credit, but not traditional overdraft services

- Many types of installment loans, with some specific exceptions

MLA doesn’t cover credit that is secured by the property being purchased. That includes residential mortgages, mortgage refinances, home equity loans or lines of credit, or reverse mortgages. It also doesn’t cover loans on motor vehicles when the credit is secured by the motor vehicle you are buying or a loan to buy personal property when the credit is secured by the property you’re buying, such as for jewelry or a home appliance.

Determining if SCRA or MLA Benefits Apply to You

The military benefits you receive on credit cards depend on when you open a credit card account.

- SCRA benefits apply if you open an account before you are an active duty servicemember.

- MLA benefits apply if you open an account while you are on active duty.

If you apply for the credit card account while you are on active duty orders, or if you are a Guard or Reservist on 30-day or greater active orders or a dependent of an active duty service member, you are eligible for Military Lending Act (MLA) benefits while you are on active orders or a dependent of someone on active orders.

Qualifying for SCRA Benefits

If you apply for the account before your active duty orders, you are eligible for SCRA benefits while you are on active duty.

The SCRA applies to the following servicemembers:

- Active duty members of the Army, Marine Corps, Navy, Air Force, and Coast Guard;

- Members of the Reserve component when serving on active duty;

- Members of the National Guard component mobilized under federal orders for more than 30 consecutive days

- Active duty commissioned officers of the Public Health Service or the National Oceanic and Atmospheric Administration.

- SCRA rights may be exercised by anyone holding a valid power of attorney for the servicemember.

- Some SCRA protections also apply to dependents. SCRA benefits apply to spouses and children of qualified servicemembers and any person who relied on the servicemember for at least 50% of their support for up to 180 days prior to invoking SCRA benefits.

Qualifying for MLA Benefits

To qualify for MLA benefits, the credit account must be established while you or your active duty sponsor are on active duty orders lasting more than 30 days.

Borrowers covered under MLA are defined as:

- Active duty member of the Army, Navy, Marines, Air Force, Space Force, or Coast Guard

- Guard or Reservists on 30-day or greater active orders

- A spouse or child dependent of an Active Duty member of the Armed Forces as defined in 38 USC 101(4)

Major Credit Card Issuers and SCRA/MLA Benefits They Offer

While all card issuers must comply with SCRA and MLA laws, some credit card issuers go above and beyond laws on the books to support servicemembers and their families. Finding the right card depends on how you’ll use the card and what other benefits issuers offer for all users such as cash back categories, various promotions, and more.

Here are some of the biggest banks in the US and banks that specifically serve military members, and some of the SCRA/MLA benefits they offer servicemembers and their dependents.

The simplest way to check if you will receive MLA or SCRA protections on your account is to check the MLA Database or SCRA Database.

The MLA and SCRA database are the same databases that the credit card companies check to determine if you qualify for MLA or SCRA benefits.

If you are not listed as eligible in these databases, you will not receive MLA and SCRA benefits applied to your account.

You must be listed as eligible in these databases for the credit card companies to apply your military benefits.

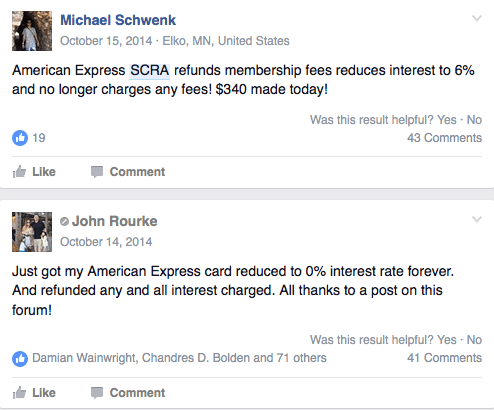

American Express

American Express complies with all SCRA and MLA requirements.

The SCRA applies to Consumer, Small Business, and Corporate Card products and closed-end credit loan products. This even includes The Platinum Card from American Express and the American Express Gold Card, two of the best credit cards on the market. Eligible American Express customers will receive relief on accounts opened before the start of the servicemember’s active duty period, including credit cards and personal loans.

How to submit your request to American Express

Submitting your request online is the fastest way to request SCRA relief. You may also submit any relevant documents through the Document Center. This includes paperwork establishing active duty, such as documentation prepared exclusively by a branch of the military, the Department of Defense, or your commanding officer that indicates that you are on active duty (e.g., active duty orders, change of station orders, DD-214 forms, letters from commanding officers, etc.).

You can also the number on the back of your Card or 1-800-253-1720 to submit a request. If you are outside the United States, you can call collect at 1-336-393-1111. A third option is to send a copy of documents establishing your active duty status to: American Express, Attn: Servicemembers Civil Relief Act, PO Box 981535, El Paso, TX 79998-1535.

SCRA relief is available only on accounts opened prior to active military duty. For accounts opened while on active military duty, MLA coverage will be determined at the time of application, and those accounts will be ineligible for SCRA relief.

Please note that SCRA relief can only be requested online if the Card account for which you’re requesting relief is enrolled in American Express Online Services. If it is not, you may enroll your Card now.

American Express will advise you of your status up to 2 billing cycles after you submit your request.

The Platinum Card® from American Express

American Express offers one of the best money-saving perks to military servicemembers – it waives the annual fees for its credit cards, including on The Platinum Card® and the American Express® Gold Card.

With an annual fee of $695 and $250, respectively, it’s easy to see how this under-the-radar perk can be a huge money saver for American Express cardholders, especially if you’re a service member who wants to enjoy the lucrative luxury perks that accompany The Platinum Card® from American Express, or the everyday practicality of the American Express® Gold Card.

Now that you know you can get your American Express annual fee waived as an active service member or spouse of a service member, what are some American Express cards to check out?

Learn more about our favorite below:

Armed Forces Bank

You will need to check with Armed Forces Bank to find out what SCRA and MLA benefits you qualify for when you have an account with that institution.

Contact the bank here.

Both the Visa Credit Card and the Credit Builder Secured Visa Credit Card from Armed Forces Bank do not carry annual fees, so the fee waivers under the SCRA and MLA are less impactful than those for some premium travel cards from other providers.

Bank of America

Bank of America complies with SCRA laws, including waiving fees and lowering your APR to 6% for all pre-service balances during active duty and for up to 180 days after separation.

Go here for more information to see if you’re eligible.

Learn more about all Bank of America SCRA policies on their FAQ page, or apply for benefits in several ways.

Phone:

877.345.0693 (outside the U.S., call collect: 817.245.4094)

Monday – Friday, 9 a.m. to 8 p.m.

Fax:

866.696.0292 (outside the U.S., fax collect: 302.525.5889)

Attn: Military Benefits Unit

Mail:

Military Benefits Unit

PO Box 673026

Dallas, TX 75267-3026

Overnight mail:

Military Benefits Unit

Department FL96000297

9000 Southside Blvd.

Jacksonville, FL 32256

Email:

Don’t send personal information via email unless it is sent through a secure method.

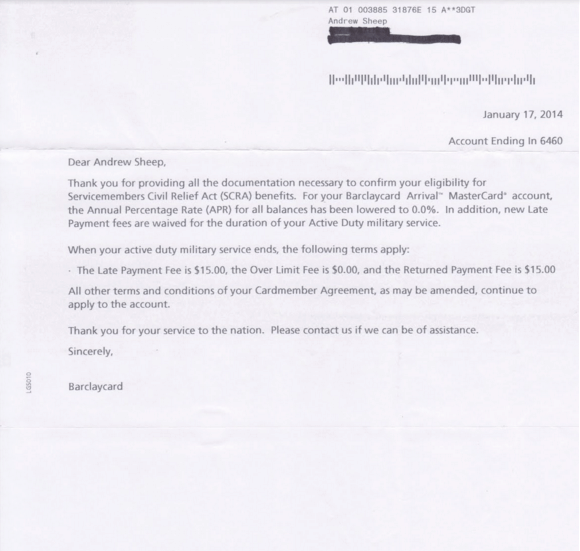

Barclays Bank

If you opened an account before active duty, Barclays Bank offers 0% APR and no annual fees on credit cards during active duty. However, members who began active duty and are now looking at a Barclays card will not be considered SCRA eligible and, therefore, are responsible for any fees and standard interest rates that apply to a card.

Contact Barclays at 1-888-710-8756 to get more information or to apply for benefits.

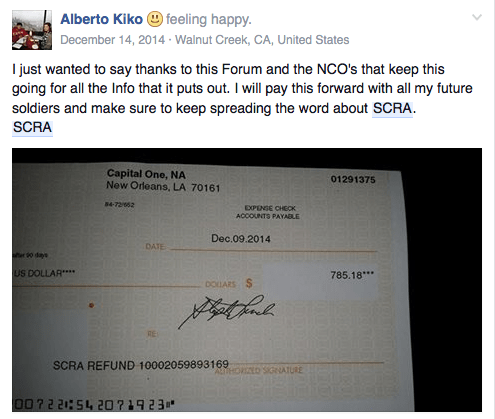

Capital One Bank

Under the Capital One SCRA Program, all fees are waived on all cards, and service members can enjoy 4% APR during active duty and for one year afterward.

It’s easy to apply for these benefits online or you can call 855-227-1645 to speak with a Capital One Military Specialist. This line is available 24/7.

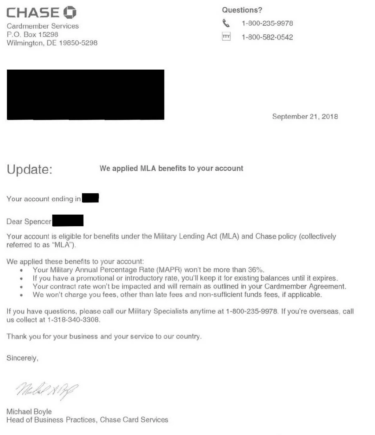

Chase Bank

Chase Bank will waive all fees and lower the APR to 4% on eligible balances and for one year after separation. On Chase Military cards, all interest and fees incurred during deployment will be refunded as part of Chase’s SCRA benefits program.

Call Chase Military Services at 877-469-0110 about these and other servicing benefits available to you. Specialists are available Monday – Friday from 8 am to 9 pm ET. If you’re calling internationally, call 1-318-340-3308.

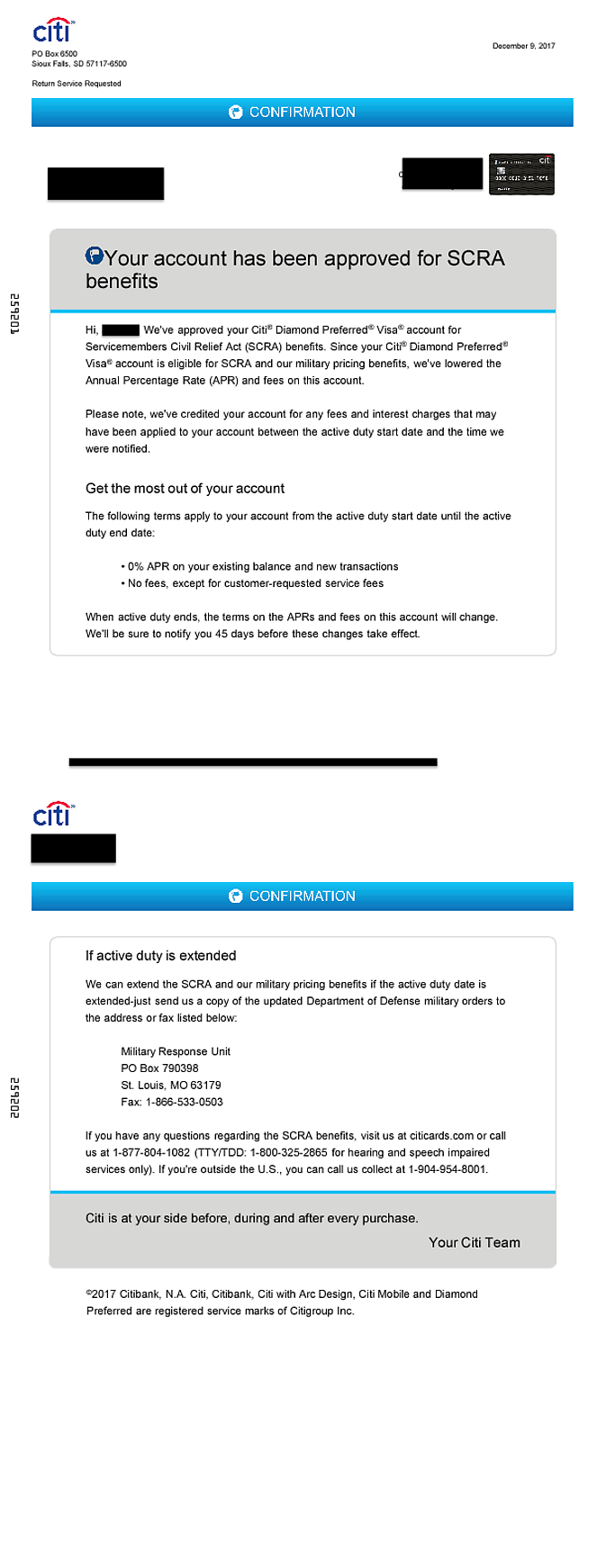

Citi

For accounts opened before active-duty service, Citi offers a 0% APR during active duty. They will also waive all fees on these accounts. Outside of active duty, standard variable APRs and rates apply.

To discuss benefit details, Call Citi’s military specialists 24/7 at 877-804-1082 in the U.S. and 605-335-2222 if you’re overseas.

You may also fax, mail or overnight/express delivery to the fax number and address for Citi listed below. Please ensure you also send the proper documentation – this could include a copy of your written Department of Defense (DoD) orders, a letter from your commanding officer, or any other document that the DoD deems a substitute for official orders.

For credit cards, mortgages, and other banking products from Citi:

Citi Customer Service

SCRA Unit

P.O. Box 790398

St. Louis, MO 63179

Fax: 1-866-533-0503

Discover Card

If eligible, Discover Card service members will receive an interest rate not exceeding 6% on debt incurred before active duty, including most fees, for the duration of the service member’s active duty.

There are several ways to apply for benefits.

- Online: Click ‘Request Benefits Now’ when securely logging in to your account.

- Phone: Call 1-844-DFS-4MIL (1-844-337-4645). If you are overseas, call 1-801-451-3730. (If your active duty time period is in the future, provide your active duty dates.)

- Mail: Discover Attn: SCRA Department P.O. Box 30907 Salt Lake City, UT 84130-0907

- Fax: Attn: SCRA Department 1-224-813-5767

Discover will attempt to verify active duty by contacting the Defense Manpower Data Center (DMDC). If verified, no documentation is required; however, service members are encouraged to submit documentation that may provide additional information.

Once activated, your SCRA benefits may automatically extend to other Discover products, such as personal loans, home equity, home loans, and student loans.

If the account is enrolled in Discover Payment Protection, you may be eligible to pause your monthly payments, interest fees, late fees, and Payment Protection fees during your call to active duty. You can call 1-800-290-9895 to speak to a specialist about pausing your payments.

First Command

First Command Bank specifically targets military families to assist them with a variety of financial issues. Nine out of 10 advisors are veterans or military spouses who are squarely focused on serving as personal financial coaches to service members and military families.

To discuss SCRA benefits, contact First Command at 800-763-7600.

Navy Federal Credit Union

Your Navy Federal accounts may be eligible for SCRA benefits if they were opened before you started active duty. This includes:

- Consumer loans

- Mortgages (including Home Equity Lines of Credit)

- Checking Lines of Credit

- Credit cards

- Business loans

- Student loans

You must request SCRA benefits from us no later than 180 days after your active duty end date. To get started, you’ll need to complete a Request Benefits form.

For your convenience, you can submit your form in any of the following ways:

By eMessage: You can easily send a message from your Navy Federal online account or from the mobile app. In the subject line, please write: ATTN: SCRA, Mortgage Servicing.

By Fax: Send your fax to 703-206-3108, ATTN: SCRA, Mortgage Servicing.

By Mail: Navy Federal Credit Union P.O. Box 3000 Merrifield, VA 22119, ATTN: SCRA, Mortgage Servicing.

Visit Your Local Branch: A branch representative will be happy to assist you in submitting your form and/or documents to SCRA.

Pentagon Federal Credit Union (PenFed)

SCRA benefits through Pen Fed are effective on the date your active duty begins and generally end on the date you are discharged or released from active duty. To apply for benefits, you’ll need to submit documentation.

Gather your activation orders. You can send your activation notice up to 180 days after the last date of your active military service. Upload your documents to PenFed.org/secureupload.

Pen Fed will review your request and let you know if more information is required.

If you have questions, you can submit a request for more information here or visit a branch to get answers.

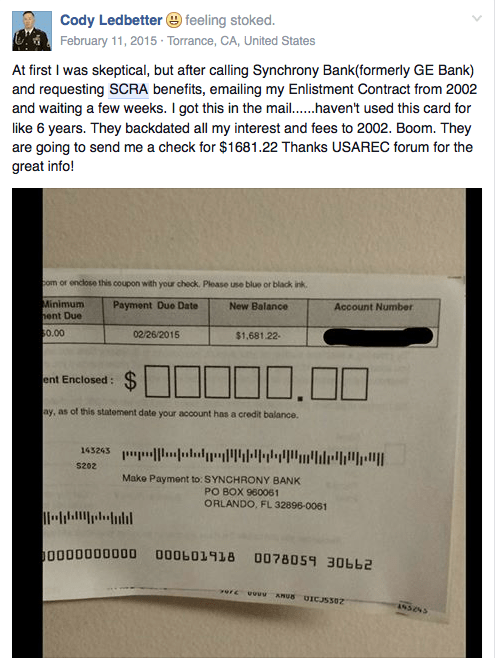

Synchrony Bank (formerly GE Capital)

Synchrony Bank will review all current and closed accounts under GE Capital and, if approved, reduce interest rates to 6% and waive all associated fees.

You may also be eligible for 0% interest from Synchrony Bank for new accounts created after joining military service.

Please fax your request, including active military orders or other documents, to (866) 694-6580 or mail it to Synchrony Bank, SCRA Dept, PO Box 965074, Orlando, FL 32896.

For details, contact Synchrony Bank at 1-855-872-4311 or 1-866-419-4096, and be ready to provide your social security number and a recent LES.

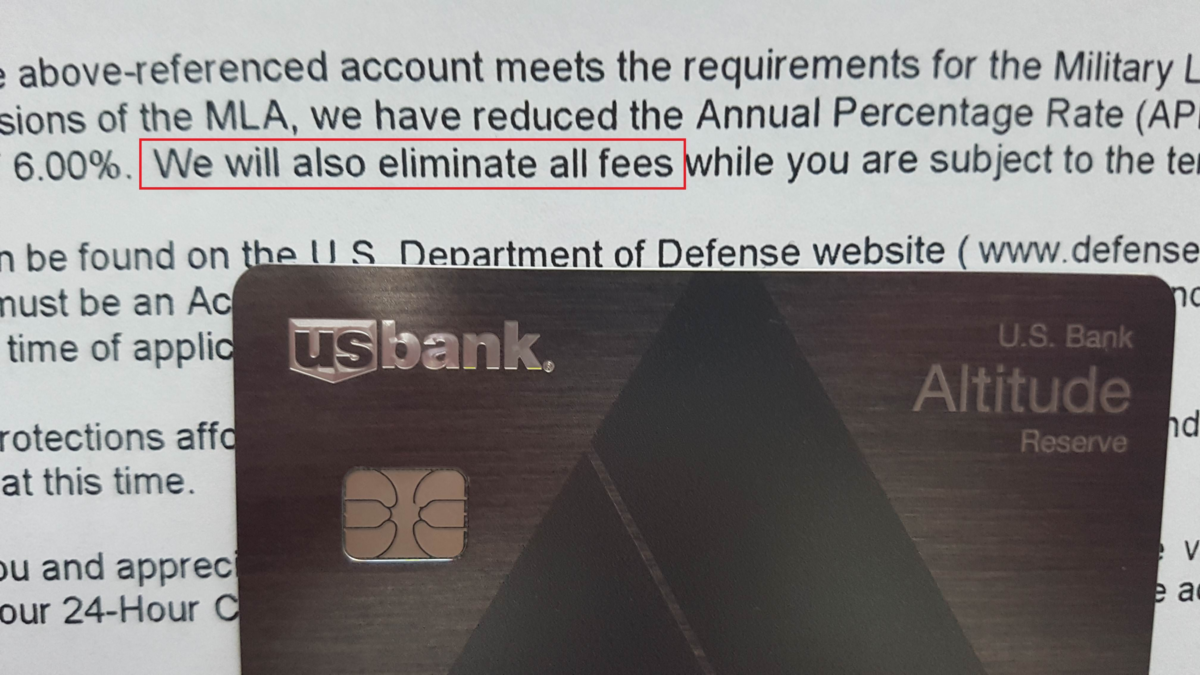

US Bank

While US Bank offers the required SCRA benefits, it does not offer special offers beyond what is required by law.

US Bank can help you understand your rights when you contact the Military Service Center and assist you with benefits.

Phone (in the U.S.): 800-934-9555

Phone (international collect): 513-277-5899

Email: [email protected]

Hours of Operation: Monday – Friday, 7 a.m. – midnight (ET)

USAA

USAA offers several servicemember-friendly benefits related to SCRA. These include

- A reduced interest rate of 4% on eligible credit card balances.

- Waiver of credit card account-related fees when approved for the program.

- Extension of approved benefits for one year after active duty end date.

Contact USAA at 800-531-USAA (8722) and request assistance.

Wells Fargo

Wells Fargo offers the required SCRA benefits but there are no special offers above and beyond what is required by law. To take advantage of SCRA benefits with Wells Fargo, sign on to Wells Fargo Online® to easily and securely upload your military service documentation.

You can also send your military service documentation through these other ways:

Mail/Overnight Mail:

Wells Fargo Bank

c/o SCRA Request

DSR – MAC D118-02M

1525 W. WT Harris Blvd.

Charlotte, NC 28262-8522

Fax:

1-855-872-6262

Wells Fargo branch

Find a location near you

Email:

For secure email options, call 1-855-USA-2WFB (1-855-872-2932).

For More Information

If you have questions about your SCRA or MLA rights, contact your nearest military legal office for more information.

Thanks for reading… If we’re missing any credit card companies, feel free to leave the specifics in the comments!

The Military Wallet has partnered with CardRatings for our coverage of credit card products. The Military Wallet and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on The Military Wallet are from advertisers. Compensation may impact how and where card products appear, but does not affect our editors’ opinions or evaluations. The Military Wallet does not include all card companies or all available card offers.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Tina Dale says

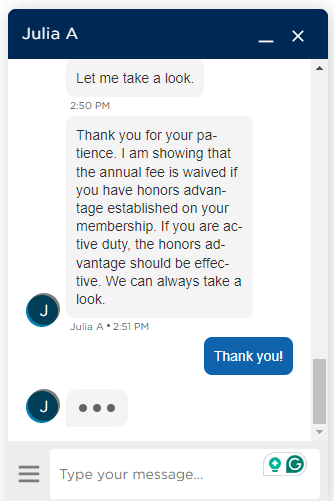

We recently contacted all our former and present lenders and to date we have received back $13,832.83 in statement credits and/or checks. Target by far was the fastest, but we’ve also had great success with Citi and Discover. Although we haven’t seen a refund yet from Synchrony, they lowered all our interest rates to 0%. Finding the contact information for some banks was a little time consuming, but for almost $14k, it was well worth my time.

Mario says

I am in the USCG and currently on my 14th year of AD. I’ve been denied SCRA benefit from Wells Fargo, Navy Federal, and USAA because my debts with them were acquired AFTER joining, and that benefits only apply for debts acquired BEFORE joining the military. I called USAA and asked them directly about how they had advertised to help AD members and they said that the word “may” was placed in the ad because not all active duty members are eligible for benefits, and they refuse to explain to me what would make one AD members eligible and not another.

USAA is my primary bank and I’ve sent them proof of PCS orders and copies of my AD enlistment contract, and they really stuck to quoting me what the SCRA requires of them, and they were quick to say that they really have no obligation to do anything more than that.

This is really frustrating and almost insulting as I have known other active duty USCG member who have applied and been approved (through USAA) and now have 6% APR on all their credit cards. All on accounts that were created AFTER enlisting too. When I asked USAA about my coworkers receiving these benefits, they implied that they must be lying to me because it’s not something that they do.

If anyone has dealt with this and has found solution, please let me know.

Andrea says

Does anyone know if USAA or Navy Federal reimburses the interest paid when using the SCRA on debt acquired prior to joining the military?

Zachary Coleman says

Hi, is there an updated number for Synchrony Bank? The number above is no longer valid.

Thank you,

tania says

has anyone tried it with bbva? will they refund what you have paid on the interest on auto loan?

Matthew Malinski says

Does AMEX offer SCRA benefits if you are opening a new account after you have been in the service for several years. I know that SCRA is typically for pre military debt although I know that some companies may differ. I did not specifically see the answer.

Vikas says

Synchrony aka GE Capital doesn’t appear to be ‘above and beyond’ as stated in this article. They denied my request over phone saying my account was closed. so that they can keep all the insane interest charges. They also refused to give me that denial in writing, which was sketchy. Now exploring my options with the Justice Department and also trying to see where the author got such information ‘ as Syncrony GECapital will pay for closed accounts too’?

Christina says

After retirement do they apply the old interest rate on current balances?

Jason Dayne says

Does anybody know if there are any special considerations for SCRA for the Palace Front people in terms of trying to get retroactive benefits for prior active service while called back up on active orders?

Tamra says

My husband is in his 18th year with the Army National Guard. While most creditors will not honor his deployment back in 2006, Synchrony (Walmart, Sam’s, Lowe’s, QVC, etc.) WILL!!! They told me they include the Guard, beginning with their enlistment date!!! We will have retroactive benefits on those accounts since 2001! So excited!

Sarah says

Has anyone experienced issues with trying to apply for SCRA benefits for a spouse with Chase and US Bank? They want to tell me I have to have primary financial responsibility for it to apply to them but I had no problems and even had 2 others ask me if my spouse had card accounts with them as well so they could apply the benefits to them as well.

Doug Nordman says

Outstanding, Mike, thank you!

Chad charles says

So I applied for the SCRA benefits from Synchrony bank, which I had a Lowe’s card with a $4200 balance on. I also had a Walmart store credit card as well as a Sam’s Club store card which I closed a few years ago. (I used Sams and Walmart cards to help restore my credit.) For the Lowe’s account I went on line to pay my bill a few days after receiving my paper copy in the mail and I only had a balance of $600. That was a blessing. Then a few weeks later I was scrolling through some emails and seen I had emails from Walmart and Sams which said your statement is available to view. I thought well that’s weird I don’t have those cards anymore…dug up my old passwords and lo and behold a positive balance on Walmart for 490$ and 998$ on Sams. I called both and they sent me two checks. What a great program.,..I’m awaiting Victoria’s Secret (not holding my breath) and Capital One. Question does anyone know if Kay Jewelers offers anything for SCRA? Have a great day!

mike says

Credit one bank and Comenity Bank (Victoria’s secret, Buckle, Zales) only honor SCRA if you were a member prior to joining the military so I guess it’s only good for Privates. I’ve been in 18 years so they won’t offer it to me. Capital One however did. They lowered interest to %4 and backdated it to my career so in this case the life of the card. Basically they paid off my balance and sent me a check for $200

sarah thomas says

Synchrony bank is retroactively dropping all of my interest rates to 0%!! (These are newer accounts, opened after I came in the military. They really go above and beyond!) Thank you so much for sharing!

Jennifer says

Has anyone had success with Chase or USAA for credit cards opened AFTER the start of active duty?

Andrea Doolittle says

Hello all,

We were approved for SCRA through Synchrony bank (Amazon). When will we receive the money from the interest we have been paying?

Jon says

Does anyone know how long synchrony takes to refund interest paid? I received a letter and check my accounts. The interest has been reduced to 0% but no credits.

Thanks in advance for ya’lls help.

Ryan says

I’ve had a amazing luck with most of the credit card companies I’ve reached out to, giving benefits for both open and closed accounts. However, both Honda and Standard Mortgage are telling me that SCRA doesn’t apply because both of those accounts are already closed. Any advice on how to handle that? I’ve read the SCRA and nowhere does it mention that accounts have to be open in order to qualify for benefits. Thank you.

Jennifer says

I sent my husband’s DMDC certificate to Chase, but they didn’t care! They said the current title 10 orders don’t matter bc they had old title 32 orders on file (he’s AGR with the Guard), but the title 32 orders were NOT for a national emergency authorized by the president. I’m contacting the dod on Monday and will pursue legal action if necessary.

Samuel Guzman says

Just FYI, I have 2 credit cards under Synchrony bank (Amazon and Gap) and I called in my SCRA benefits recently. They reduced my interest rate to 0% and will reimburse me for interest and fees charged from the date of my enlistment. Happy camper! 🙂

Curtez says

Yes, once you submit a request they should review all open/closers accounts to determine your eligibility.

Tim says

I am aware of the difficulties and inconsistencies with Chase approving SCRA benefits for accounts created after joining. However, I’m curious if anyone has had any success with the following scenario:

I have been AD for about a year and a half and recently PCS’d to an AFB where I am projected to be stationed for the foreseeable future (at least 6 years). I am very interested in the 100k sign-on bonus for the Chase Sapphire Reserve card. If I apply, get accepted, get the card, then get deployed (complete with new orders)… will they know my [ineligible] active duty joining date (through possibly contacting the DoD) or do they only know the date on the newly issued deployment orders I’ll be sending them as proof of AD status (which would appear to make me eligible for SCRA benefits)?

Jae says

Amazing. Thank you for creating this blog and providing such valuable information. To receive a credit that you weren’t expecting can change your financial status.. i can pay off a few bills, reduce debt and take a much needed vacation.. what an economy booster.. These companies are going above and beyond! I feel SO appreciated!

Kristy says

This is great, thank you. Only two issues – 1, VS # you gave will refer you to call their home office, at 614-415-7000. 2, not everyone with a VS card is the “spouse” of a SM….some of us can be sexy and serve too! 🙂

Arnold V says

Does this work for an already close credit card with BOA? I used to have a credit card with them? The Apr rate was rediculous, which really hurt when you are only a private!

Curtez says

Sorry, this article is specifically for Credit Cards…

Elaine says

I applied for SCRA benefits from Capital One (all cards opened prior to AD service) and had a negative balance on my account within a few days. I called to get the money refunded to me and had two checks within 10 days. I was skeptical until the checks cleared my bank! They are amazing!

Doug Nordman says

I can’t speak for Samuel’s experience, Al, but many of the credit-card companies mentioned in this post have offered SCRA terms for those who obtained the cards after starting their military service.

Some companies offer the more generous terms as a sort of military discount, while others simply comply with the SCRA. You’ll have to contact your card companies to learn their policies. Before you open a new account, ask them about their military terms.

samuel guzman says

Hey All, my credit cards were all acquired before I joined. But you may be right. Synchrony Bank may be going above and beyond. It seemed like they only wanted my enlistment documents for the in order to reimburse me the interest and fees charged since that date.

Tim says

**UPDATE: I found out about the DMDC (Department of Defense Manpower Data Center) website where credit card companies (or anyone, civilians included) can look up a service member’s active duty date with only a couple pieces of info (name and birth date).

Alex Gibson says

Anybody know if comenity bank honors SCRA on pre-AD debt as well? Or know what comenity offers as a whole? I’m not finding any info on them.

Danie says

i called us bank to get the info needed as our mortgage was with them, they said we did not qualify as you had to have the mortgage with them before joining the military.

Maria says

How long did Capital one take to reply to your request?

Al says

Just out of curiosity, did you obtain these cards prior to your active duty service date or after? I called a few credit card companies, some would not honor if cards if they were obtained after entering active service but after speaking with synchrony rep, it seemed that it did not matter. Just wanted to confirm if this was the case.

Britt says

I’m a spouse and Discover, Chase, and Capital One all extended the same benefits to me, which was awesome. But I just called about my Synchrony and not only are the extending the same benefits, they drop the interest rate to 0%. I’m blown away right now. Thanks for providing the number to call.

danie says

US Bank….you had to get the loan before joining active duty…how does that even work under the SCRA?

Francis says

Capital ONE is excellent. They went back to 2000, when I entered the service although I got my card in 2005. They forgave the $5000 balance and I had a $3500 credit on the card. Happy Happy Day.

Gail says

Just denied by Wells Fargo even though we have been and still in for 23 years. Claim credit debt was before entering

Chad Davis says

Does this apply for credit cards acquired after you joined the military, or just credits card from before you joined?

Curtez says

Nick, long time my friend! Keep me posted of your results.

Nick says

As always you find the cracks in the system that these companies will never openly share with service members. It’s a shame we have to even “look” for this or ask. Great resource here. I have at least four of these cards in past accounts and plan to test this next week.

Doug Nordman says

Fantastic, David, and that’s great progress!

Doug Nordman says

Thanks for the great news, Tamra!

You’ve highlighted the importance of contacting each company to ask them individually, whether or not that company seems to have honored he requests of other military families.

Thomas says

Curtez, great article and this should benefit several Soldiers. Now, did you forget AAFES? https://www.myecp.com/HtmlPages/MR_DPolicy

Joy Dallas says

This is such a great resource! This a great read for any full time active duty personnel. These companies are truly rising above! I am glad to see our military being treated well!

Curtez says

Thanks for the comment Joy!

David Martin says

Hello, I’m a spouse of a AD Air Force I have applied for SCRA on all my credit cards which I have had years prior to my spouse’s AD & marriage. So far within 1 week of applying discover card has already credited $1284 in interest paid since my spouse has been AD & they lowered my interest to 5.9% as long as spouse is AD. Thanks for the info still waiting for Amex, Citi, Chase, & Bank of America to respond. If they retroactively credit my accounts as well to AD service date which is 2 years I could potentially get 10k to 12k back. This would be awesome. Yes I had a lot of credit card debt (over $100k) and just paid them all off this month.

Curtez says

Thanks. I wanted this article to focus on the companies that went above and beyond the basic requirements of the law. Unfortunately for most of us with a balance, being deployed shouldn’t be a point of consideration in order to qualify for the meager break… Especially considering the volume of Soldiers that are restricted to AAFES, you would think they’d be a little more considerate. Now, that’s just my opinion. We all choose which places we spend our money, or swipe our cards.

Doug Nordman says

Good question, Chad, because it can seem a little too amazing to be true.

The SCRA law applies only to debts (and accounts) incurred before starting active duty. (This includes Reserve/Guard mobilizations as well as joining the military.) However the card companies in this post have been going above and beyond the SCRA requirements.

When you contact them and explain your duty status (including the applicable dates) they may still decide to voluntarily comply with the SCRA requirements– even though the law might not apply to your particular account situation.

There’s no deceit or manipulation. It’s just the financial companies doing a good thing for servicemembers & families.

Chad Davis says

Thanks Doug! It is good to see companies doing this. This defiantly cleared it up for me!

Curtez says

Danie,

I’m not exactly sure that I understand your question. Here’s the link to US Bank if you have specific questions: https://the-military-guide.com/credit-card-companies-support-scra/#US_Bank

Chris says

If you read the scra, it actually states that it should be applied to pre-active duty debt. These companies are going above the spirit and extending it to debt incurred after enlistment.

Curtez says

I’m glad that it worked for you. Please share the post so others can see the value.

Rita says

Hey Britt, I am a spouse as well. When you fill out the form to fax in for Capital One, did you put your information in or your husbands? It says “about the servicemember”

Thanks!

Doug Nordman says

Ryan, if the debts were incurred before active duty then the interest rates could be required to comply with SCRA. But if the accounts are closed (especially if they were closed after payoff, not delinquent or sent to collections) then the companies may have complied with SCRA.

This is a situation where you may or may not have paid more interest than required by the SCRA, but it could cost you far more in legal fees to obtain a resolution.

Doug Nordman says

Jon, we don’t have any recent data on payment times. You might want to e-mail or call every few weeks so that the company doesn’t “forget” about their policy.

Whitney says

Hey Jon! Did you ever get refunded interest? And if so.. How long did it take?

Elaine says

Took me two months to get money from Synchrony. With the wait!

Whitney R says

Did you ever get anything back from interest you’d been paying after they reduced interest rate to 0%?

Andrea Doolittle says

Hi! Thanks for responding. Was it by check or did they just apply it to your balance?

Elaine says

All three accounts had credits posted to my balance. I requested the refund via online for one and received the check in about 2 weeks. The other two were closed accounts. I’d forgotten about them, but glad Synchrony didn’t! One account emailed me a statement reflecting a credit and the other mailed me a statement showing that credit. I called the number on each statement and requested a refund check through the automated system. I should receive those checks in 10 working days. Together they equal $2600. Happy camper!! I’m a Synchrony fan!

Andrea Doolittle says

Eek that makes me nervous. We looked on our statements and they lowered the interest rates but nothing has been applied interest paid wise. 🙁

Doug Nordman says

Good question, Jennifer!

Note that USAA offers benefits on credit cards during PCS or deployments, or even for campaigns. Those USAA credit cards could have been opened before the start of active duty, but most USAA members opened their accounts after starting active duty. Give USAA a call, read them the USAA part of this post, and see what they can do for you.

The same advice applies for Chase. Some servicemembers have received benefits in excess of the SCRA laws, but that decision is up to the card issuer. The policies seem to change every few months, so the best advice is to contact Chase for their SCRA benefits. You can also ask for any additional benefits that they may offer under the Military Lending Act, which was extended in October 2017 to apply to all credit cards.

britt says

My husband and I each had a Chase card opened after the start of active duty. They did not grant him any SCRA benefits. They did grant me benefits because I opened the card before we got married (even though it was after he enlisted).

Jason Dayne says

In case my question isn’t clear, the assumption is that the member has no break in service, but rather transitions from active duty status to that of a traditional guardsman.

Doug Nordman says

You’ve asked a great question, Jason, and I hope that a reader will have a specific answer.

Until that happens, let me give you a practical approach which doesn’t depend on a specific program.

Card companies and airline call centers don’t understand (or pretend not to understand) the differences between the Servicemembers Civil Relief Act and the Military Lending Act. Their lawyers make sure they comply with both but the marketers (and the call centers) tend to go above & beyond those requirements without specifically announcing a special deal. These policy changes not only come & go at unpredictable times but might even be interpreted differently by the various call centers.

Once in a while it’s easier (less expensive) for them to give you what you’re asking for instead of spending their time & resources to argue with you.

The best approach is to contact your card issuer to see what they can do for you. Search their website for the “military” keyword and read their fine print. Ask the call center. If they want what they call “active duty orders”, then it’s usually orders for a period of at least 30 days (the kind which come with Tricare benefits). You’re interested in their policies for debts and contracts incurred before that active duty (under SCRA) or what they can offer active-duty servicemembers (under the MLA). These benefits might also extend to military spouses. You could even contact USAA about their mortgages or insurance policies.

If you don’t get what you ask for on the first call, and you have the hardcore patience to pursue your goal, then wait a few days and call again. (Hopefully you’ll speak with a more knowledgeable rep, or they’ll have logged your first request for a higher review.) You could even follow up your calls with a letter asking for a specific policy reference.

This way you don’t have to depend on someone else’s anecdotal experience, and you don’t have to wonder whether an offer is still effective.

Doug Nordman says

Christina, that’s completely up to the card companies. When servicemembers are no longer on active duty then the card companies are no longer subject to the SCRA laws.

It makes a lot of sense to pay off a credit-card balance at its lower interest rate before you retire.

Jonathan Tuttle says

You still need an open account with them. Just go get a Lowe’s card or something.

Doug Nordman says

Matthew, Amex might waive the annual fee on a credit card for an active-duty servicemember or spouse (under the Military Lending Act). You wouldn’t have any SCRA benefits on a new account because you wouldn’t have paid any interest on it.

Amex’s generous SCRA refunds of interest and fees were paid in the months before the October 2017 implementation of the MLA for credit cards. They might still offer SCRA refunds for active-duty servicemembers who incurred the debt before starting active duty, but they have no motive to offer them for servicemembers paying interest on a new account.

The consistent advice of this blog post and its comments is: call the card company and ask them the question for your specific situation. The policies are constantly changing, and any offer they make to you is tailored to their estimate of your future customer value.

Doug Nordman says

Thanks, Zachary, we’ve updated Synchrony’s phone numbers.

Doug Nordman says

Corporate policies change all of the time, Andrea, and the best advice is to contact those companies to ask them to do so.